Investor Fuel and Kiavi

Capital at the ready

Kiavi is honored to provide Investor Fuel Club members with reliable, robust capital designed for how you do business today and supports your scaling business for tomorrow. Take advantage of our low rates and experience easier access to funding for your next project.

High leverage

No need to drain your funds. We offer up to 90% LTC

Competitive rates

Maximize your returns with robust capital, high leverage, competitive rates and a variety of loan options

Fast, simple process

Kiavi’s tech platform eliminates time-consuming tasks, speeding up the closing process.

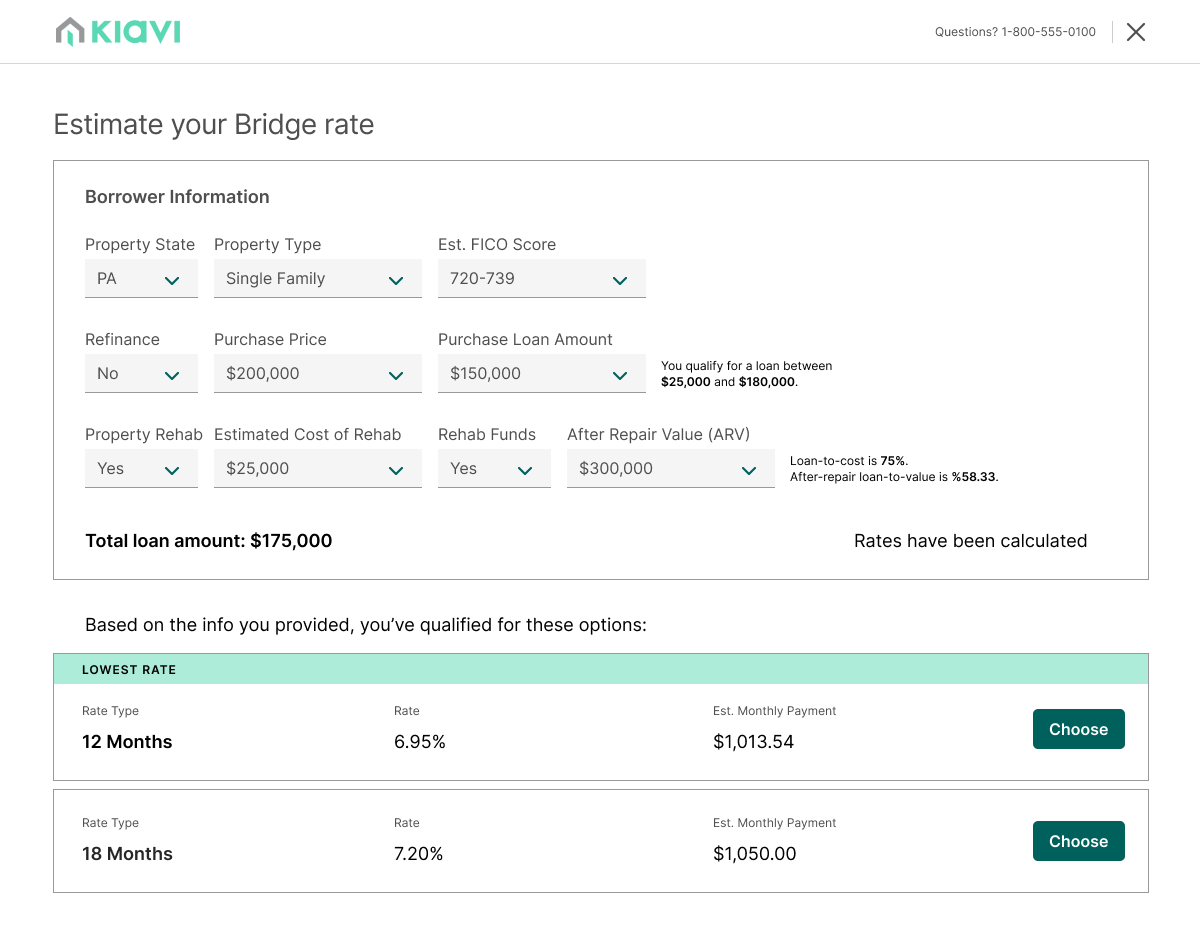

Fix and Flip / Bridge loans

Our short-term financing options for the purchase and rehab of investment properties feature competitive rates with a variety of terms and options.

Fix-and-Flip Rates + Terms

Rental loans

Our long-term financing for rental properties is designed to help real estate investors reap the benefits of property appreciation and rental income. Available for single-family, PUDs, and 2-4 units.

DSCR Rental Loan Rates + Terms

Bringing lending for REIs into the digital age

Traditional lenders rely on human decision-makers and paper-based processes. At Kiavi, our advanced tech platform removes many traditional barriers, automates time-consuming manual steps, provides quick approvals and true transparency throughout the entire process.

Imagine being able to skip spending hours submitting complex applications, waiting for approvals and babysitting the steps to close. Our customers are truly able to focus on scaling their portfolios instead of how they fund their deals.

Kiavi gives me the confidence to not only access reliable capital to close more deals, but provides a fast platform and industry support that helps my company scale.

Marcel Bonee

Southern CA based real estate investor*Bridge loan rates and terms are based on a combination of factors: LTV, FICO, and experience and are subject to change. Interest rates or charges herein are not recommended, approved, set or established by the State of Kansas.

†Rental loan rates and terms are based on a combination of factors: LTV, FICO, and experience and are subject to change. Non-owner-occupied rental properties only. Cash-out LTV is based solely on appraised value, not cost basis. Interest rates or charges herein are not recommended, approved, set or established by the State of Kansas.

All loans are available in AL, AZ, AR, CA, CO, CT, FL, GA, IL, IN, KS, KY, MA, MD, MI, MN, MO, NC, NJ, NV, NY, OH, OK, OR, PA, SC, TN, TX, VA, WA, WI, and WV, as well as Washington D.C. Prepayment penalties as allowable by state.