Solutions for Your BRRRR Strategy

Financing to unlock your BRRRR

The BRRRR strategy—Buy, Rehab, Rent, Refinance, Repeat—is a method for scaling your real estate portfolio successfully with minimal initial investment. Kiavi is your trusted lending partner in turning this strategy into a reality with our fast technology and competitive financing.

Scale your BRRRR strategy with flexible funding

When executing the BRRRR strategy, you need more than just a lender—you need a trusted lending partner who understands every phase. At Kiavi, we're here to enhance every step of your BRRRR projects with precision and ease.

Fast processes

Speed through the financing stages of your BRRRR deal with Kiavi's efficient loan processing, ensuring you close with confidence and compete with cash buyers.

Custom financing

Jump into financing options that fit the unique twists and turns of your BRRRR projects with flexible fix-and-flip and DSCR rental solutions for your unique deal.

Dedicated support

Access our financing experts who bring insights into the real estate market and can assist you in scaling your portfolio from one BRRRR to the next.

Want to learn more about BRRRR?

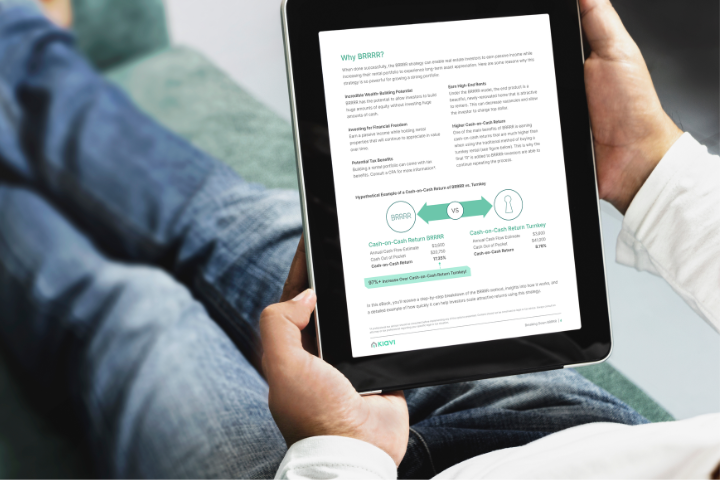

Check out Kiavi’s guide Breaking Down BRRRR: Your guide to building a rental portfolio quickly and profitably using the BRRRR method. In it, we walk you through the financing process and illustrate the cash-on-cash return of this strategy compared to turnkey investments.

- BRRRR strategy overview

- The breakdown of how to buy, rehab, rent, refinance, and repeat

- Pros and cons

- A success story and more!

Solutions to seamlessly finance your BRRRR strategy

The BRRRR strategy is made up of four essential financing phases:

1) Acquisition and rehab

Kick off your BRRRR with Kiavi’s Fix-and-Flip and Bridge Loan offerings, with up to 95% LTC / 80% ARV. Quick, flexible, and competitive, they’re perfect for fast project completion.

2) Rent and build wealth

Post-rehab, rent out your property and watch the passive income flow. Kiavi’s here to advise on pricing and management, ensuring top occupancy and returns.

3) Refinance and grow

Refinance to Kiavi's Long-Term DSCR Rental Loans for lower rates and cash-out options, freeing up capital for more deals to maximize your property’s potential.

4) Repeat with efficiency

Kiavi makes the BRRRR repeat phase a breeze. Thanks to our tailored solutions and shorter seasoning requirements, you can jump into your next project faster than ever.

Get a fast financing estimate

Stop guessing. Kiavi's proven ARV model—trusted on tens of thousands of deals—helps you quickly estimate financing for the first phase of your BRRRR project. Enter a few key details like property address and rehab scope to unlock estimates for:

- After Repair Value (ARV)

- Cash to Close

- Interest Rate

- Comparable Valuations

Get answers to your BRRRR loan questions

Everything you need to know about the BRRRR Strategy, simplified. Are you curious what properties can be used in the BRRRR method, or how refinancing would work? We’ve got the answers to these questions and more to help you navigate your next real estate investment with confidence.

The BRRRR strategy allows investors to build equity, earn passive income, and take advantage of potential tax benefits. It's designed for long-term asset appreciation and higher cash-on-cash returns compared to traditional rental property investments.

Once you've acquired 5 or more rental properties, Kiavi offers rental portfolio loans to streamline your investments under one loan. This option provides operational efficiencies, cost savings, and the flexibility to grow your real estate business.

See why 17,000+ real estate investors trust Kiavi

From first-time flippers to seasoned pros, Kiavi provides the support, expertise, and capital to make real estate investing easier.

"[...] I have worked with a few other bridge loan lenders and none of them can match the customer service or ease of use that Kiavi provides as well as an investor friendly product."

Devin K.

11/23/23 via Google"Kiavi was quick and easy to work with. I look forward to closing more deals with them soon."

Elyse G.

03/07/24 via Google"Kiavi made my hard money loan journey surprisingly smooth. Their efficiency and transparency truly set them apart. Highly recommend."

r/realestateinvesting

01/30/24 via Reddit"Fast and easy process. Everything was done in a timely manner. They were easy to reach when I had questions, and there were no surprises. Highly recommend!"

Kaveh N.

03/25/24 via TrustpilotReady to scale to new heights?

Discover how Kiavi simplifies financing for your unique investment strategy. Transparent, efficient, and tailored to your needs, we pave the way for your portfolio's growth without hidden fees or hassle—just a straightforward path toward expansion.