DSCR Rental Loans

Easy funding for all of your rental properties

Want to finance a new purchase, refinance a property, or free up cash in your rental portfolio? Kiavi makes rental financing easy with our advanced online platform and flexible rental loan options.

Kiavi’s rental investment property loans

Purchase, Rate and Term, and Cash-out Refinance options are available for single-family rental (SFR), PUDs, 2-4 units, and condos.

Competitive loan rates

Maximize your returns with robust capital, high leverage, and competitive rates.

Fast and simple process

Forget searching for pay stubs and old W-2s. Our platform eliminates these time-consuming, manual tasks.

Flexibility and support

A variety of rental loan options and a dedicated team will help maximize your ROI and create a simplified experience.

DSCR Rental Loan Rates + Terms

Kiavi calculates financing terms based on the rental property cash flow—not just the borrower—so you can move forward with confidence.

- Ask About Our Cash-Out Refinance Options

Streamline your rental property strategy with our advanced tech

Our technology, powered by billions of data points from over 100,000 projects, provides fast and accurate pricing tailored to your project.

Quick closing

Forget about searching for pay stubs and old W-2s, we don’t verify your income or employment! Our digital platform automates manual tasks and guides you through each phase to close quickly.

Easy digital platform

Our tech-forward platform eliminates time-consuming tasks, putting everything at your fingertips. Quickly apply online, get pre-qualified, and track your loan’s status.

Tech-driven insights

Expect more than just financing—we offer quick decisioning and a digital-first approach that delivers transparent and fast capital tailored to each unique rental project.

Personalized financing

Kiavi offers a variety of loan options tailored to support your buy-and-hold strategy, ensuring you have the capital you need to grow your investment portfolio at your pace.

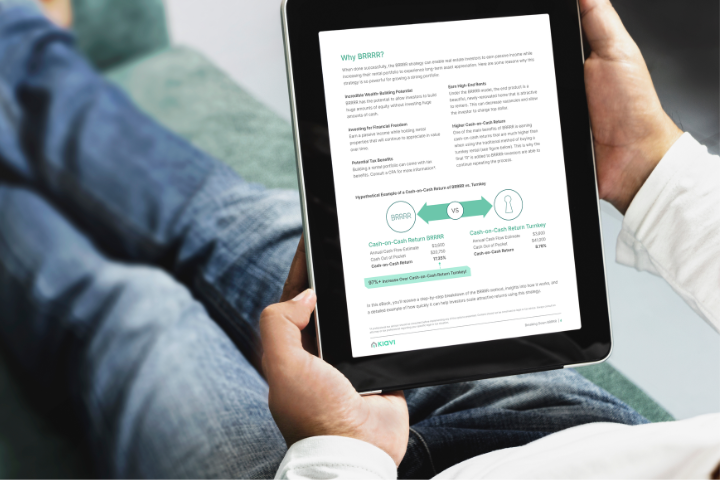

Want to learn more about BRRRR?

Check out Kiavi’s guide Breaking Down BRRRR: Your guide to building a rental portfolio quickly and profitably using the BRRRR method. In it, we walk you through the financing process and illustrate the cash-on-cash return of this strategy compared to turnkey investments.

- BRRRR strategy overview

- The breakdown of how to buy, rehab, rent, refinance, and repeat

- Pros and cons

- A success story and more!

Adjustable-Rate Mortgages (ARM) designed for Real Estate Investors

Many real estate investors (REIs) are choosing Kiavi's adjustable-rate mortgage (ARM) options to enhance their monthly cash flow. An ARM offers a fixed interest rate for an initial period, after which the rate can fluctuate based on market conditions. This flexibility makes it an attractive choice for those looking to optimize their investment property portfolio.

5/1 ARM

Fixed rate for the first 5 years with fully amortizing and interest-only options

7/1 ARM

Fixed rate for the first 7 years with fully amortizing and interest-only options

Get answers to your DSCR rental loan questions

Everything you need to know about DSCR rental loans, simplified. We’ve got the answers to these questions and more to help you confidently grow your rental property portfolio.

Yes, Kiavi offers competitive refinancing options that help investors unlock equity and improve cash flow, vital for expanding or optimizing your rental portfolio.

Kiavi's buy-and-hold financing covers a range of properties, including single-family homes, multi-unit residences, and condos, supporting various investment strategies, including portfolio

Kiavi offers streamlined financing options like portfolio loans for portfolios with 5+ properties, making it easier to manage multiple properties under one loan, saving time and resources.

Kiavi’s long-term rental loans are also known as debt service coverage ratio (DSCR) loans or no-income mortgages. How does Kiavi's approach benefit you?

- No tax or personal income document needed

- Loans are based on rental property cash flow

- Flexible qualification guidelines

See why 17,000+ real estate investors trust Kiavi

From first-time investors to seasoned landlords, Kiavi offers DSCR rental loans with the support, expertise, and capital you need to grow your rental property portfolio with ease.

"[...] I have worked with a few other bridge loan lenders and none of them can match the customer service or ease of use that Kiavi provides as well as an investor friendly product."

Devin K.

11/23/23 via Google"Kiavi was quick and easy to work with. I look forward to closing more deals with them soon."

Elyse G.

03/07/24 via Google"Kiavi made my hard money loan journey surprisingly smooth. Their efficiency and transparency truly set them apart. Highly recommend."

r/realestateinvesting

01/30/24 via Reddit"Fast and easy process. Everything was done in a timely manner. They were easy to reach when I had questions, and there were no surprises. Highly recommend!"

Kaveh N.

03/25/24 via TrustpilotLearn what makes us the trusted choice for your needs

Have questions about DSCR rental loans or expanding your real estate investment strategy? Kiavi is here to help. Beyond financing, we offer free resources like webinars with industry experts, market insights, and tips and tricks for maximizing rental income to help you stay informed and make confident decisions.

Expert guidance from an industry-leading real estate financing team

Our industry-leading team of real estate financing professionals is here to support you every step of the way. If you want to discuss financing options for your strategies, go over the numbers on a potential property or talk about your long-term goals, get started today.

.png)