Fast and flexible financing for your investment properties

As one of the largest lenders for real estate investors, Kiavi provides fast and reliable capital without the typical hassles. Take advantage of today's low rates and experience the easier way to access funding on your next property.

Competitive rates

Maximize your returns with robust capital, high leverage, competitive rates and a variety of loan options

Online processes

Our platform eliminates manual tasks to help you quickly get approved, track your loan, and speed up the closing process

Dedicated support

Grow your business with support from our industry-leading team every step of the way from submit to closing

Bringing lending for real estate investors into the digital age

Traditional lenders rely on human decision-makers and paper-based processes. At Kiavi, our modern tech platform automates time-consuming manual steps, provides quick approvals, and offers transparency throughout the entire process.

Imagine being able to skip spending hours submitting complex applications and babysitting the steps to close. It’s easy to apply online (takes less than 10 minutes), and you can then generate your own personalized pre-qualification document.

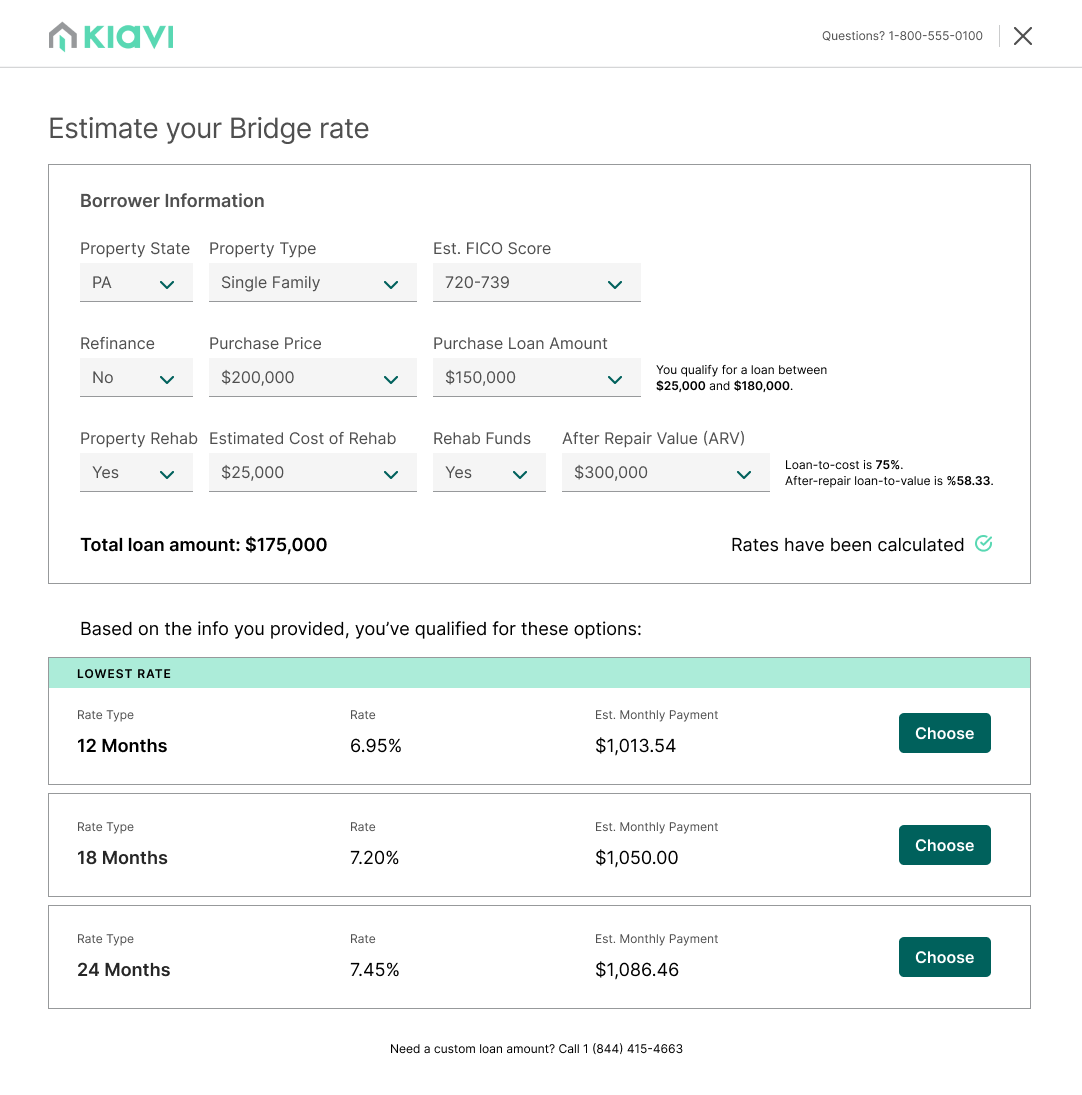

Fix and Flip / Bridge loans

Our short-term financing options for the purchase and rehab of investment properties feature competitive rates with a variety of terms and options.

Fix-and-Flip Rates + Terms

Rental loans

Our long-term financing for rental properties is designed to help real estate investors reap the benefits of property appreciation and rental income. Available for single-family, PUDs, and 2-4 units.

DSCR Rental Loan Rates + Terms

$16+ billion

in loans funded—helping thousands of real estate investors achieve success

65,000+

bridge and rental loans originated for our customers across the county

32 states + DC

served with Kiavi's simpler, more reliable, and faster way to access capital

Learn more about growing your real estate investing business

Attend a live Q&A

Learn more about our loan processes and terms with a Kiavi representative

Get smarter about BRRRR

Create passive income without a significant initial outflow of capital

Take a strategic financing approach

Discover differing factors in financing the various investment strategies

Kiavi gives me the confidence to not only access reliable capital to close more deals, but provides a fast platform and industry support that helps my company scale.