The Savvy Real Estate Investor's Guide to Rental Portfolio Loans

When exploring financing options for rental properties, real estate investors often weigh the benefits of individual loans versus portfolio loans. Understanding the financial implications is crucial for making informed decisions.

Let's look at rental portfolio loans and break down the math behind them using a real-world example to see how they can benefit you as a real estate investor.

Exploring rental portfolio loans

Imagine streamlining all your rental investments into one neat package. That's exactly what a rental portfolio loan offers you. It's like a magic trick that combines your properties under one loan, making your life a whole lot simpler.

With this loan option, you get to say goodbye to juggling multiple single-asset loans and hello to potentially lower costs and easier management. Think of it as your portfolio's VIP pass to better terms, including sweeter interest rates and reduced fees, because you bundled up. It's a smart move for growing your empire with less hassle and more strategy. So, if you're looking to scale up and streamline, this could be your golden ticket.

Before diving into a real-world example, it's crucial to grasp why understanding the structure and pricing of rental portfolio loans matters. By learning how these loans are structured and priced, you’ll equip yourself with the knowledge to make informed decisions. This means not just looking at the surface numbers but also analyzing how the loan's terms—like prepayment penalties, liquidity requirements, underwriting requirements, and other loan covenants—can play out in the long run for your investments.

Understanding this math can significantly impact your portfolio's profitability and your ability to scale your investments smartly.

Ethan's scenario: Individual loans vs. portfolio loan

Let's look at an example to outline the math behind rental portfolio loans. Keep in mind that this is just an illustration, and your actual terms could vary. Let's dive in!

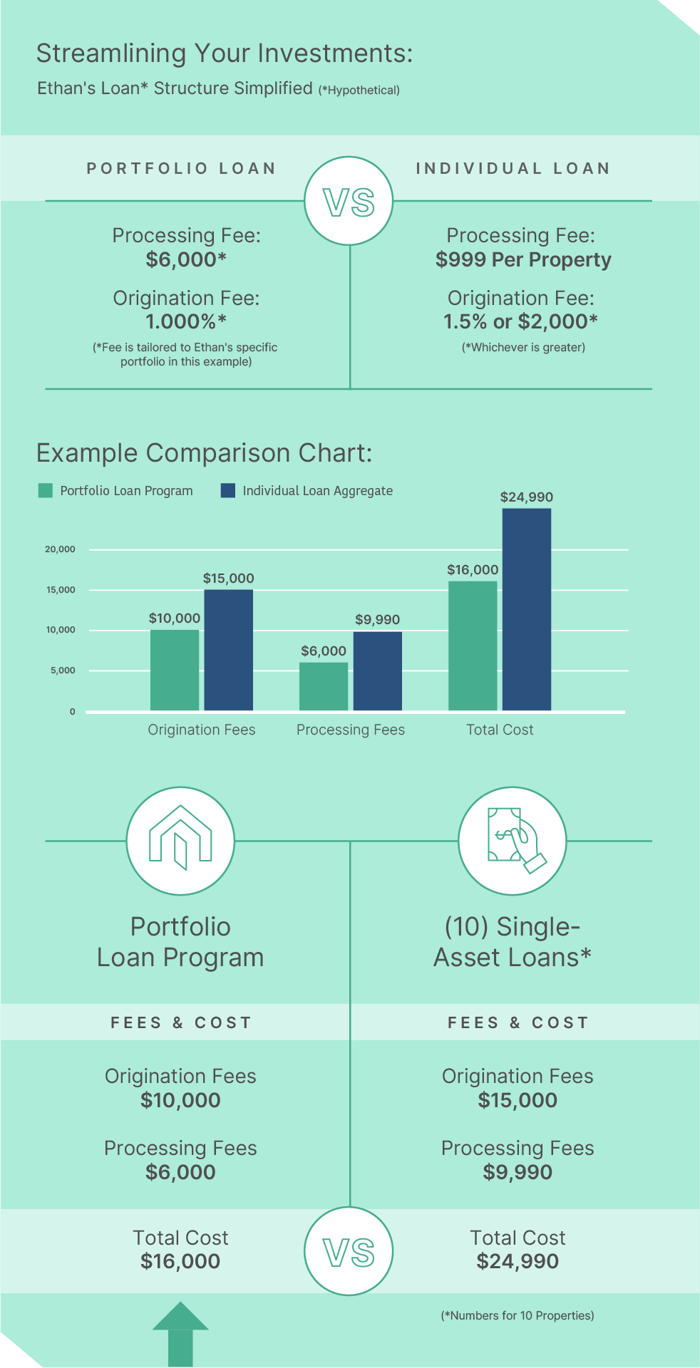

Real estate investor and Kiavi customer Ethan owns 10 rental properties. He's considering a rental portfolio loan to consolidate his investments. Here's a comparison of his options:

Individual Loan

- Processing Fee: $999 per property

- Origination Fee: 1.5% or $2,000 (whichever is greater)

Portfolio Loan (as illustrated for a 10-property loan)

- Processing Fee: $6,000 (estimated)

- Origination Fee: 1.000%

By opting for the portfolio loan, Ethan sees a reduction in upfront fees, making it a more cost-effective option.

By opting for the portfolio loan, Ethan sees a reduction in upfront fees, making it a more cost-effective option.

Interest rate savings

One of the key benefits of a portfolio loan for Ethan is the lower interest rate. Depending on the portfolio size, a rental portfolio loan can offer a meaningful reduction in interest compared to single-asset DSCR rental financing. In some circumstances, investors benefit from as much as half of a percentage in interest rate reduction! With Ethan's example, even with just a 0.250% reduction, he could save over $10,000 over five years and $20,000 over ten years. This demonstrates the long-term financial benefits of choosing a portfolio loan.

Detailed financial breakdown

Ethan's loan amount is $1,000,000 for both the individual and portfolio loans. However, the portfolio loan options offered a lower interest rate (7.250%) than individual loans (7.500%) based on his individual portfolio, leading to lower monthly payments and significant savings over time.

Additional considerations

In addition to interest rate reductions that create lower monthly payments, there are also cost savings from consolidating escrow/title fees, legal fees, appraisals, due diligence, and more. The portfolio loan simplifies these costs, offering a more predictable and manageable financial plan.

Beyond cost savings, Ethan simplifies his rental property business with just one title policy, one escrow, one set of loan documents, and one monthly payment for all 10 of his properties. Make sure to speak to your rental portfolio loan representative about these considerations and how they can affect you.

What's next for Ethan?

Seeing the numbers laid out, Ethan realizes the portfolio loan from Kiavi is a no-brainer. The lower fees and the significant interest rate cut all add up to more money in his pocket —and that’s on top of a simpler way to manage his expanding portfolio.

Now, he's gearing up to take the next steps. He'll fill out the loan application, check his FICO® score and necessary documents, and confirm his rate and LTV preference. After signing off on the term sheet and submitting the expense deposit, it's onto the processing and underwriting stages. Ethan's on the fast track to optimizing his investments, and he’s thrilled about it.

Your trusted lending partner

At Kiavi, our approach to lending is founded on a deep understanding of the unique challenges and opportunities real estate investors face. Our rental portfolio financing is designed with flexibility and each investor’s success in mind.

We prioritize transparent, straightforward processes and terms that make sense for investors looking to grow their portfolios efficiently. By offering competitive rates, cost-saving loan structures, and personalized service, we aim to empower real estate investors like you with the tools you need to succeed.

It's all about a capital partnership that supports your goals—Kiavi's industry-leading expertise and commitment to supporting the unique needs of real estate investors.