Understanding the Math Behind Pricing a Hard Money Loan

The vast majority of questions we get asked in our space are related to pricing. What is the current interest rate? What are your closing fees? What is the best rate you can offer me? These questions are fundamental and should be front of mind for any real estate investor, regardless of experience.

When asked these questions, I respond with one of my own—do interest rates matter? To best understand this, we should first understand all the pieces involved in pricing a loan.

Loan pricing

Several components are involved in pricing a loan—the interest rate, origination fee, service fee, and down payment. Understanding each element is essential to understand the loan's cost completely. It is also helpful when comparing pricing among different lenders, but we can return to that later. For now, let's take a look at each individually.

Interest rate

Simply put, the interest rate is the amount charged by the lender as a proportion of the amount borrowed. With Kiavi, bridge loan payments are interest-only, meaning each monthly payment is strictly an interest payment based on that interest rate.

Origination fee

The origination fee covers the cost of originating the loan and is a fixed percentage of the total loan amount paid at closing.

Service fee

The service fee is the cost to service the loan once it has closed and through the life of the loan. This is typically a flat fee to be paid at closing.

Leverage

Leverage is the amount of the purchase being lent and is directly related to the required down payment. For example, 90% loan-to-cost would mean that the borrower is only responsible for 10% of the purchase price as a down payment. Of course, the borrower is responsible for bringing more money to closing at lower leverage.

Structuring a fix and flip/bridge loan

There are many ways to structure a fix and flip/bridge loan. Understanding how a loan is structured is imperative to entirely understand the cost associated with this loan type.

At Kiavi, it's simple—our loans are structured at up to 90% LTC and 100% of the rehab budget, subject to an ARV cap of 75%. In other words, Kiavi will lend you up to 90% of your purchase price and all of your rehab budget, but we will not lend more than 75% of that property's after-repair value.

Other common ways to structure the loan are "all-in" cost structures and lower ARV caps. It's common with other lenders in our space to see a "90% of all-in cost" offering, meaning the lender will provide 90% of the total cost or 90% of the total sum of the purchase price and rehab budget.

Another standard offering is 70% of ARV. In this case, the lender will offer a total loan amount not to exceed 70% of the after-repair value. We will unpack these scenarios in a couple of real examples below.

Example 1

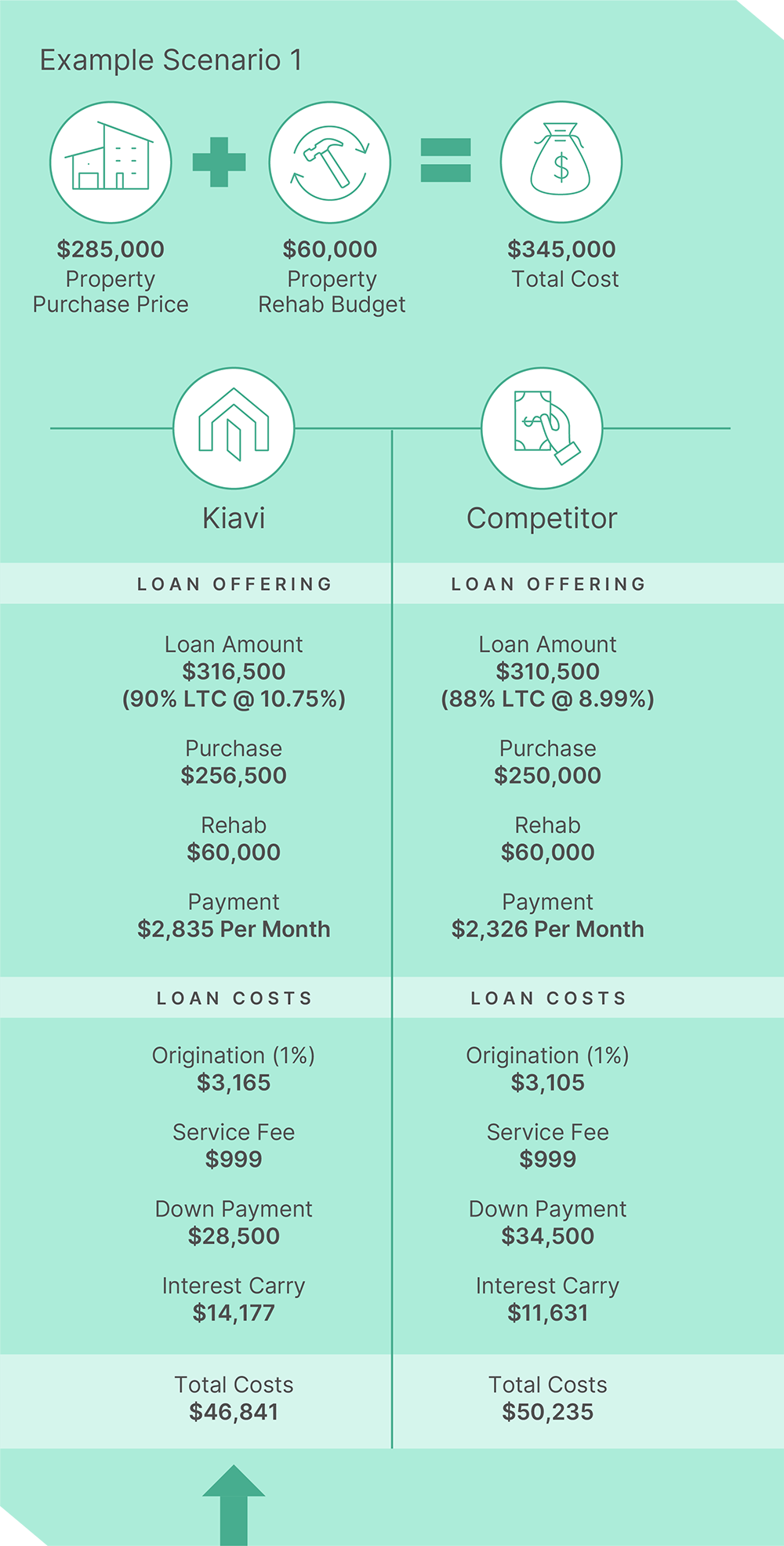

Our first real example is born from a scenario where a customer asked me if I could match a price offer he received from another lender.

The other lender offered the same fees as Kiavi—a 1-point origination fee and a $999 service fee. However, the competitor offered a rate of 8.99%, nearly two points less than our rate of 10.75%. On the surface, the offer seemed very competitive and challenging to beat.

The caveat here, though–something that my customer was not even aware of–the competitor was offering this at 90% all-in, which is quite different from the 90% LTC offered by Kiavi. It's also important to note that this customer tends to hold his property for about five months to allow time to complete the project. We call this the average hold time, which in this case, it's about 150 days.

So, what's the difference for the real estate investor in this scenario? Let's go to the math.

Using the example above, we can see that this customer would be spending an additional $3,394 if they chose to go with the lower interest rate offering from our competitor. The main takeaway, "90% all-in" is not the same as 90% LTC.

The lower interest rate from the competing lender seemed great on the surface. Still, when we dug deeper to understand the fundamental nature of the offering, it was more expensive than Kiavi's offer from a cash-on-cash return perspective. If the customer had gone with the competitor, they would have had to bring an additional $6,000 out of pocket to close the transaction.

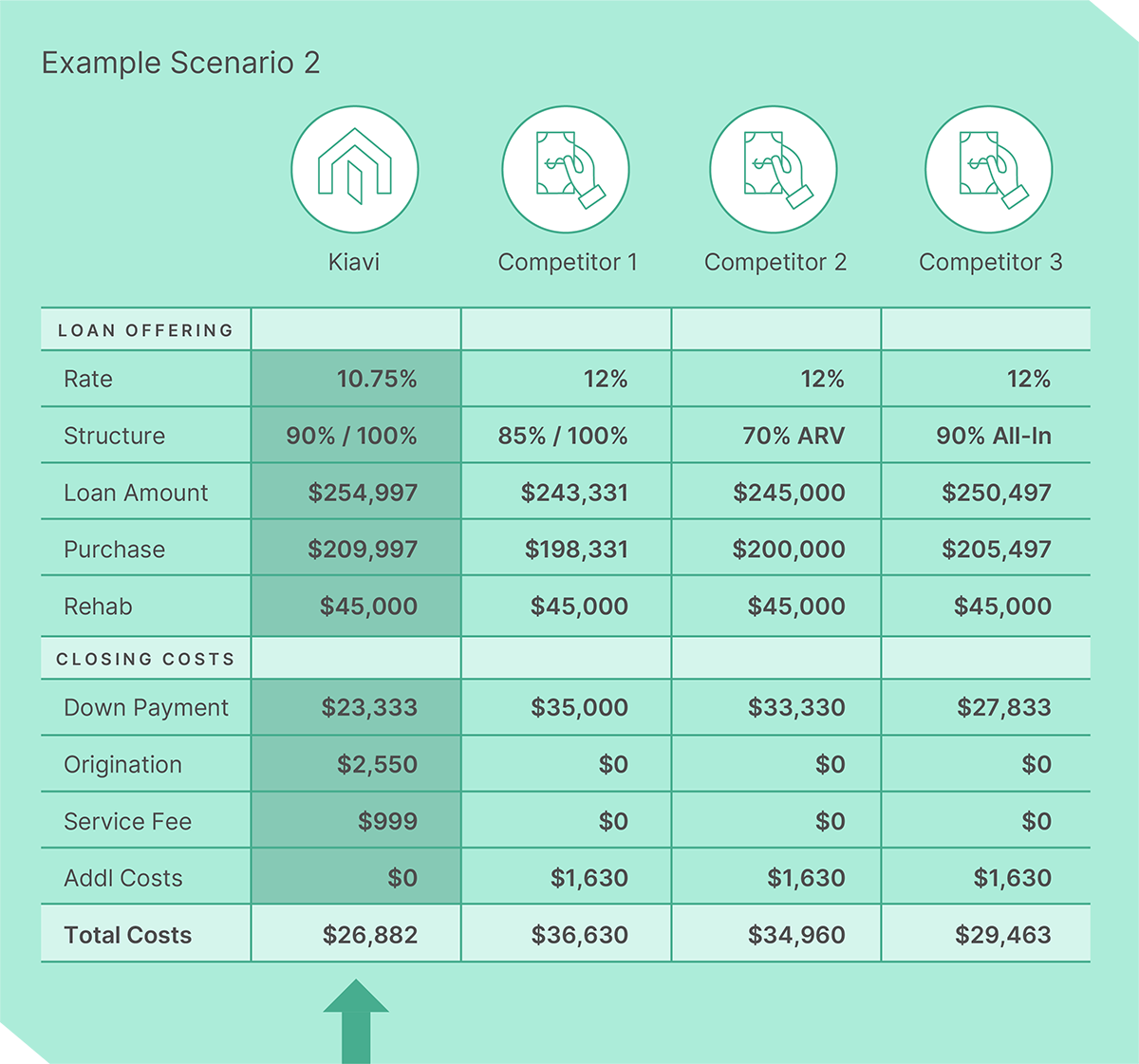

Example 2

In our second example, a client asked me a similar question from a different perspective. The competing lender offered 12% interest and zero points or fees to close the deal. The only closing costs he would be responsible for in addition to acquiring the property was a flat $1,630.

The real estate investor was enamored with the prospect of paying nothing at closing, and because he flips his properties quickly, the higher interest rate was not a concern. He shared the offer with me, and knowing how important it is to understand the differences in how we structure our loans, I examined the competing offers.

The competing offer included three options—85% LTC / 100% Rehab, 70% ARV, or 90% of all-in costs. The caveat being the competitor would lend the lesser of these three options. What does this mean for the real estate investor? Again, let's go to the math.

Here we can see that despite offering "no closing costs," the real estate investor would still pay more in every competitor's scenario. Moreover, our borrower would have had to go with the competitor's offer – the lesser of the three – which, in this case, was the 85% LTC option with a loan amount of $243,331. Comparing this offering to the Kiavi offering, the borrower would have paid around $10,000 more despite the competing lender's "no closing cost" offering.

The bottom line

Several parts make up a loan's pricing. When considering different offerings from hard money lenders, a real estate investor must examine each of these parts separately to see which has the lowest complete loan cost. It's all a numbers game, and math doesn't lie. Taking the competing offers and running scenarios by calculating the math behind each one will give you the answers you need to make the best decision.