Rental Portfolio Loans

Streamline your rental business with ease and confidence

Partner with trusted experts to craft a rental portfolio loan as unique as your investment strategy. Save time, money and headaches - so you can focus on scaling your portfolio with confidence.Rental portfolio loans built for investors

Once you’ve acquired 5+ rental properties, it’s time to start thinking about them as a portfolio instead of individual units. By aggregating all of your properties under a single portfolio umbrella, you’ll see benefits across the board.

Peace of Mind

Create more separation between your personal life and your business with features like limited recourse and carve out guarantees†

Cost savings

With economies of scale across your portfolio, we’ll work with you to craft a loan with tangible cost savings when compared to your individual rental properties

Operational efficiencies

With one monthly payment for all of your rental properties - underpinned by Kiavi’s simple process - you can free up time and cash to focus on growing your business

Flexible loan options

With various loan term lengths (plus extension options), flexible prepayment options, and more, we’ll partner with you to craft a loan that works for your business

Easy loan processes

No need for capital expenditure reserves, extra documents like bank statements, or a cumbersome underwriting process - saving you headaches and time

Competitive rates

Competitive rates and favorable terms based on your portfolio make up and FICO score. And the terms only get better as your portfolio grows.

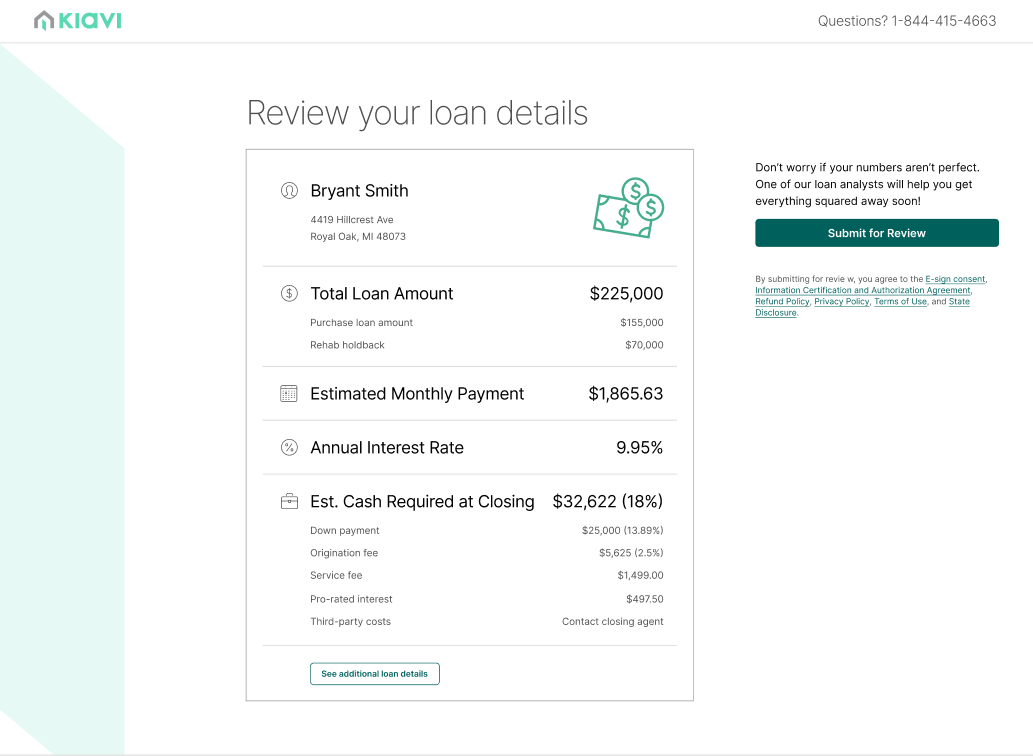

Competitive rates and terms tailored to your portfolio

Kiavi’s Rental Portfolio Loans combine your properties under one umbrella with a low monthly payment to make managing your growing rental business easier and more cost-effective.

Rental Portfolio Loan Rates + Terms

The larger your portfolio, the larger your savings

When it comes to real estate investing, there is no such thing as one-size-fits-all. That’s why we’ll partner with you to create a loan uniquely tailored to your portfolio. This means customizing a loan for your thriving portfolio with lower fees, points, and even quicker closings. And that’s all backed by our team of seasoned rental portfolio experts dedicated to helping you navigate your options and setting you up for long-term success.

Kiavi gives me the confidence to not only access reliable capital to close more deals but provides a fast platform and industry support that helps my company scale.

Marcel Bonee, Southern CA-based real estate investor

$12.3+ billion

of loans funded

50,000+

projects funded

32 states + DC

where we lend