Working with Kiavi

The complete guide to DSCR rental loans

In real estate investing, timing is everything, and a hot seller's market requires quick approvals and reliable capital — this is where DSCR loans come in. Also referred to as investment property loans, non-QM loans, and rental loans, DSCR loans are popular amongst real estate investors looking to grow their rental portfolios.

This guide takes a deeper look at this non-traditional long-term financing option.

Financing for rental property investments

Investing in rental properties has long been considered a sound investment. That sentiment continues to hold true as tenant demand, occupancy levels, rental income growth, and property values soar. The current white-hot rental market is spurring serious and novice real estate investors to scale their rental portfolios.

But finding rental properties to add to your portfolio is just the first step. Accessing flexible financing and a dependable lender to help grow your business is integral. In the current market environment, it's not easy to close on a great rental property deal quickly without that.

Investors can eliminate traditional funding's tight restrictions and opt for a targeted, goal-focused rental investment debt-service coverage ratio (DSCR) loan - a smart investment property financing solution that offers several easy features like no hard credit pulls, income verifications, or strict FICO scores to qualify.

What is a DSCR rental loan?

Before learning the ins and outs of a rental property loan, it's beneficial to understand the calculation and purpose of the debt service coverage ratio. Lenders use this ratio to determine if you have sufficient funds to repay your debt. The lender will use this information to decide how much money to lend when requesting a loan or refinancing an existing one.

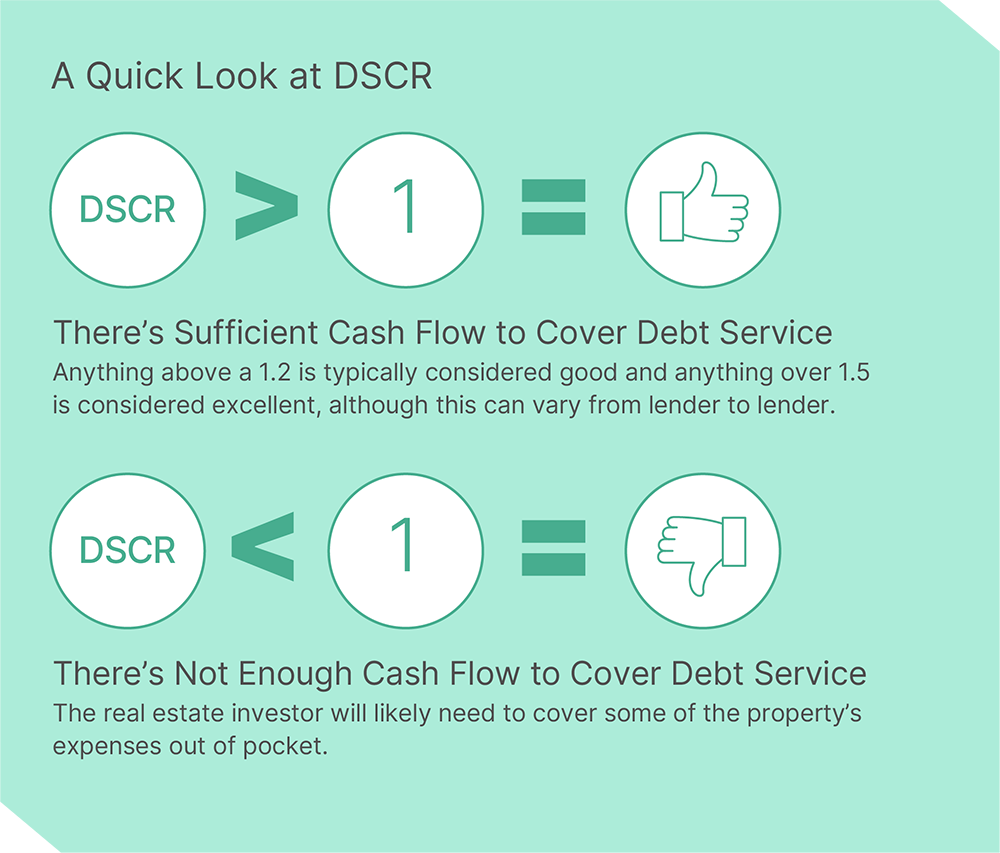

DSCR is the ratio of income generated for every $1 owed to the lender. The higher the ratio is, the more net operating income is available to service the debt. For example, a 1.25x DSCR reflects that the asset generates $1.25 for every $1 owed.

Put simply, the DSCR looks at all the monthly debt payments associated with the property, including loan payments, and compares them to the property's monthly revenue. The lower the DSCR, the greater the risk you may have to go out of pocket to pay the loan should the property sit vacant, or the operating expenses turn out to be higher than expected.

What is Debt Service Coverage Ratio (DSCR)?

Before learning the ins and outs of a rental property loan, it's beneficial to understand the calculation and purpose of the debt service coverage ratio. Lenders use this ratio to determine if you have sufficient funds to repay your debt. The lender will use this information to decide how much money to lend when requesting a loan or refinancing an existing one.

DSCR is the ratio of income generated for every $1 owed to the lender. The higher the ratio is, the more net operating income is available to service the debt. For example, a 1.25x DSCR reflects that the asset generates $1.25 for every $1 owed.

Put simply, the DSCR looks at all the monthly debt payments associated with the property, including loan payments, and compares them to the property's monthly revenue. The lower the DSCR, the greater the risk you may have to go out of pocket to pay the loan should the property sit vacant, or the operating expenses turn out to be higher than expected.

DSCR calculation for a single-family rental property

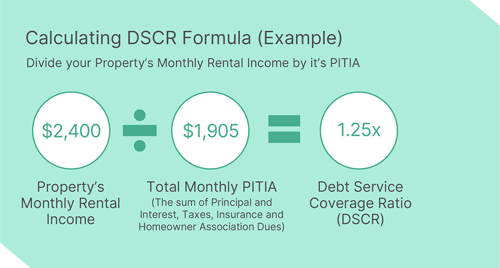

A simple way to calculate your DSCR and measure your cash flow is to divide the monthly rent by the PITIA (principal, taxes, interest, insurance, and association dues). The resulting ratio lends insight into your ability to pay back the loan based on your property's monthly rental income.

Note: Each lender will likely have a slightly different method of calculating DSCR, so it's best to inquire about exact numbers with your lender.

Qualifying for a DSCR loan

When qualifying for a DSCR loan, the lender considers several factors, including the borrower's credit score, available down payment, and the debt-service coverage ratio of the property. Typically, the credit score dictates the interest rate, and leverage is determined by credit score and DSCR combined. DSCR measures the asset's ability to pay the property's mortgage and expenses — so the higher it is, the more leverage the investor can get, which means less out-of-pocket cash at closing.

If you're looking to obtain a DSCR loan, it's best to be aware of these basic requirements:

- Minimum Credit Score Required: DSCR lenders like Kiavi often require a certain FICO® Score for pre-qualification.

- Minimum Down Payment or Equity: Maximum loan-to-value (LTV) on rental loans varies from lender to lender. They can range from 70%-80% depending on property type, credit, and DSCR. The remainder will be your down payment.

- Minimum Property Value: Lenders like Kiavi typically have a minimum property value requirement.

Reach out to your dedicated Kiavi representative to learn more about Kiavi's requirements.

What is a good DSCR?

Lenders often consider a "good" DSCR to be 1.25 or higher because it shows that the property generates 25% more profit than expenses and has a positive cash flow as long as it stays occupied.

The closer you are to breaking even, the less cash flow you'll obtain from the property, thus making it a riskier investment. In other words, if your DCSR on a particular deal isn't at least 1.0, your rental income is less than your total debt service, which means you would lose money each month. This is why it’s important to “do the math” on each deal before moving forward—in this case, avoiding the deal would probably be best.

Typical DSCR Loan Options

Most hard money lenders offer fixed-rate, adjustable-rate, or interest-only options on a DSCR loan. This allows you to choose the best terms for your property deal to maximize your monthly cash flow. Additionally, eligible (√) and ineligible (X) property types for a DSCR loan include:

Single-family rentals (SFRs)

2-4 unit rental properties

Attached and detached planned urban developments (PUDs)

Mobile homes

Vacant land

Log homes

Houseboats

How does a DSCR loan work?

DSCR reveals whether or not a real estate property is bringing in enough money to cover the loan. When a real estate investor applies for a new loan or refinancing an existing one, the lender will evaluate the DSCR as a financing qualifier and use the property's cash flow during underwriting to determine a borrower's eligibility.

The DSCR loan is tailored for real estate investors looking to qualify based on the cash flow generated by their rental property, rather than relying on traditional documentation like income proof, tax returns, or employment details. This approach aligns with flexible DSCR loan terms that prioritize property performance over personal finance.

That means you won't need to provide tax returns or pay stubs or prove your income to qualify. Because you avoid the lengthy income verification process, this loan option allows for a quicker, more simplified financing process, resulting in faster and easier access to capital.

Why do real estate investors use DSCR loans?

You can borrow as an entity or LLC

Many experienced real estate investors prefer to borrow through an LLC or corporation, and several private money lenders require you to have an entity. Doing so adds an extra layer of protection to your personal assets should anything go wrong with the investment property. Traditional mortgage loans, however, can only be obtained in an individual's name.

You have an increased ability to scale your rental portfolio

Even if you have enough personal income to support multiple mortgaged rentals, traditional lenders have maximum limits on the number of mortgages they allow a borrower to have at one time. This is not the case with most DSCR lenders. Instead, they use common sense when evaluating your maximum credit exposure.

Refinancing options are available

Most DSCR programs also provide rate, duration, and cash-out refinancing options. In certain scenarios, a DSCR loan may permit you to withdraw more money from an investment property than you would be able to with a conventional loan, allowing you to use the equity to purchase your next property.

Less documentation is required

Chances are you've experienced the rigmarole of applying for a traditional mortgage. You have to jump through hoops to gather paycheck stubs, bank statements, tax documentation and more as the underwriters dive deep into your personal financial documents and history.

This process can be time-consuming, tedious and frustrating. This is not the case when you work with a DSCR lender. Because they're focused on the investment property's value and expected cash flow, they won't typically ask you for documentation to verify your employment, income or assets.

Pros and cons of DSCR loans

To determine whether this investment strategy would work for you, check out these DSCR loan pros and cons.

Pros

Increased Accessibility

Because lenders don't consider your personal income, DSCR loans are much more accessible —even if you don't have a large amount of liquid capital.

Greater Investment Protection

Since DSCR loans allow you to borrow on an LLC or business entity, you can further protect your personal assets and other investments.

Quicker Closings

By cutting out income verification, the application process is simple, allowing you to close deals quickly.

Scale Faster

With a traditional mortgage, you often can only commit to one property at a time. With a DSCR loan, you can take out different loans for different properties simultaneously up to your exposure limit. Plus, you can refinance with a cash-out option to purchase your next property.

Cons

Specific Loan Qualifications

Qualifications are weighted toward a good DSCR ratio to get the highest leverage and best rates and terms.

Higher Interest Rates and Down Payment

Typically, interest rates are higher, and a larger down payment is required on a DSCR loan than a traditional mortgage.

What to look for in a DSCR lender

If you're new to DSCR loans, knowing where to begin might not be very clear. Not all hard money lenders are the same, so it's essential to understand how to choose one that will be as honest, respectful, experienced, and efficient as you need. Here are some questions you should ask potential hard money lenders about their DCSR loans

Are you experienced working with real estate investors?

When searching for a DSCR lender who is knowledgeable in working with investors, it is beneficial to investigate certain characteristics that could indicate their level of experience. These indicators can help to determine how well the lender is prepared to fulfill your financing requirements as a real estate investor.

- How long the lender has been in business

- How many of the lender's projects have successful exits

- How many projects the lender has funded

- The dollar amount of loans funded

- If they specialize in DSCR or rental loans

- How well they know local rental market trends

What are your fees?

Before you commit to any loan, you must know the total financing costs to ensure you don't incur any unexpected charges at the end. Typically, there will be a processing fee and some type of administrative payment, such as an underwriting or service fee. A trustworthy lender will be transparent about any additional expenses or hidden fees.

What are your eligible property types?

Different lenders offer varying types of loans. For instance, some may have DSCR loan programs, particularly for vacation rental purposes, while others may not. Additionally, there are variations regarding warrantable or non-warrantable condos and multiplex properties.

Get easy access to capital you can count on

Want to finance a new purchase, refinance a property, or free up cash in your rental portfolio? Kiavi makes rental financing easy with our advanced online platform and flexible loan options.