Using Bridge Financing to Fund Your Next Rental Investment Property

Networking with savvy real estate investors is impossible without hearing the term BRRRR. That's because the BRRRR strategy is a powerful method to create wealth from real estate investing. BRRRR stands for Buy, Rehab, Rent, Refinance, Repeat. Here's how it works:

- Find a distressed property below market value

- Buy the property

- Renovate the property

- Rent the property

- Refinance the property to pull out as much of your cash as possible

- Repeat the process from the beginning

To take a look at a powerful hard money financing strategy behind BRRRR, we're going to focus on the first three pieces — buy, rehab, rent, and refinance to illustrate how you can optimize cash-on-cash returns by using a bridge (fix-and-flip) loan to fund your next rental property.

The starting line—using a bridge loan to fix and flip a distressed property

What if you don't have enough cash to buy and rehab a house? Or what if you want to do multiple deals at a time? It takes money to make money, and very few people have the luxury of unlimited cash to fund real estate deals.

Bridge loans, also known as fix-and-flip loans, are a short-term solution provided by private money lenders or hard money lenders to real estate investors. These loans could offer up to 90% of the purchase price and 100% of the renovation budget, and they are secured by the property being purchased or renovated. Unlike other loans, bridge loans do not require W2 salaried employment or tax returns and can be processed swiftly.

What's so interesting about a bridge loan—and what makes it such a good option for those new to real estate investing—is that the collateral can be the property's projected value after the rehab is complete. This can be organized in two distinct ways—basing the amount you can borrow on the after-repair value (ARV) or the loan-to-cost (LTC) ratio. Bridge loans can provide a way to invest in BRRRR projects without needing to dedicate a large portion of your own capital.

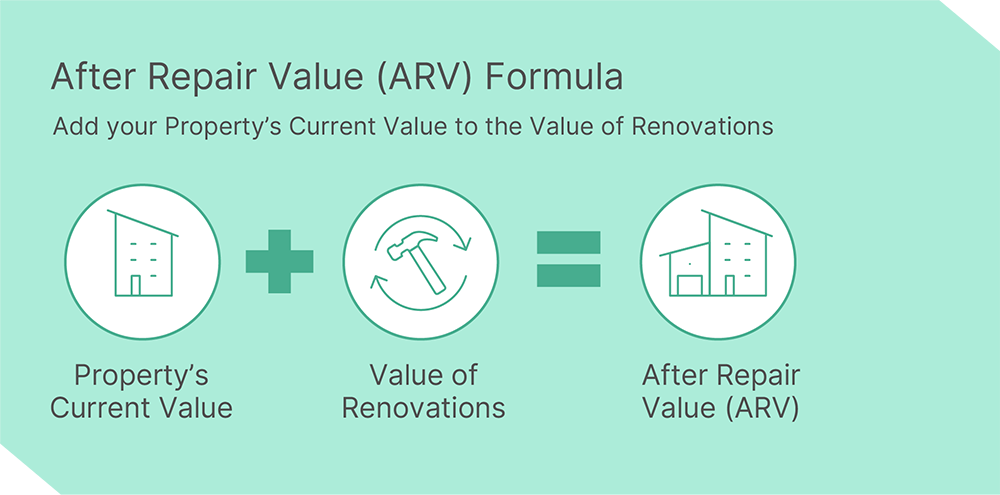

After Repair Value (ARV)

The after-repair value is the anticipated worth of a property after renovations, updates, or repairs have been made. It is estimated by analyzing recently sold homes in the same area which are of similar age, size, construction, and design. Most hard money lenders will not provide a loan exceeding 70% of the property's predicted after-repair value.

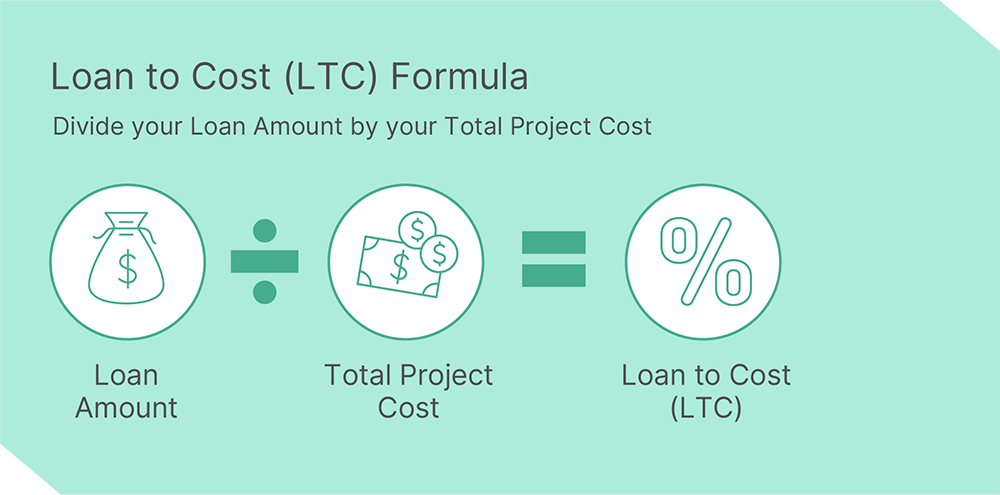

Loan to Cost (LTC) Ratio

Hard money lenders will use this ratio to determine the percentage of funding you can expect on a purchase. For example, if a lender tells you that they loan 80% LTC, you can expect to receive a loan of 80,000 when your purchase price is 100,000. You will need to bring the difference to closing as a down payment.

Next step — cash out refinance into a DSCR loan (rental investment loan)

A cash-out refinance is a way to access your rental property's equity and use it for your own financial gain. By taking out a new loan, paying off the existing one, and keeping the difference, you can use the cash to invest in other properties, build equity, and gain tax benefits. These are all important benefits of investing in real estate.

A cash-out refinance for a rental property can create liquid funds to be used for a variety of purposes, such as procuring capital for investments, improving an existing property to boost rental rates and increase its value, and settling other real estate debts or personal loan debts to free up cash flow for another rental purchase.

Seasoning

Simply put, seasoning is the amount of time a property has been owned or has had an active loan. While this "waiting period" varies from lender to lender, most progressive, investor-friendly institutions have an average seasoning period of six months. In many cases, lenders will not allow investors to refinance their property if it has not been seasoned for the appropriate length of time.

With most hard money lenders having a seasoning period of six months, this means BRRRR investors are often limited to recycling their cash twice in a single year. Compare this with lenders that have a three-month seasoning, where the same stack of cash can be recycled four or more times within one year. Although these lenders may have slightly higher interest rates, this cost is significantly offset by the speed and volume you can achieve.

What is a DSCR loan?

DSCR rental loans are a great way to purchase a rental property, allowing real estate investors to qualify for financing based on the property's cash flow instead of their personal earnings. These loans especially benefit real estate investors with unsteady incomes, those with many rental properties, or those wanting to expand their rental investments quickly.

When getting approved for a DSCR loan, the lender's decision is based on the property itself and not on the individual applying for it. This makes it the ideal solution for real estate investors wanting to get a loan based on the revenue from their investment property rather than having to provide confirmation of income, tax forms, and employment information.

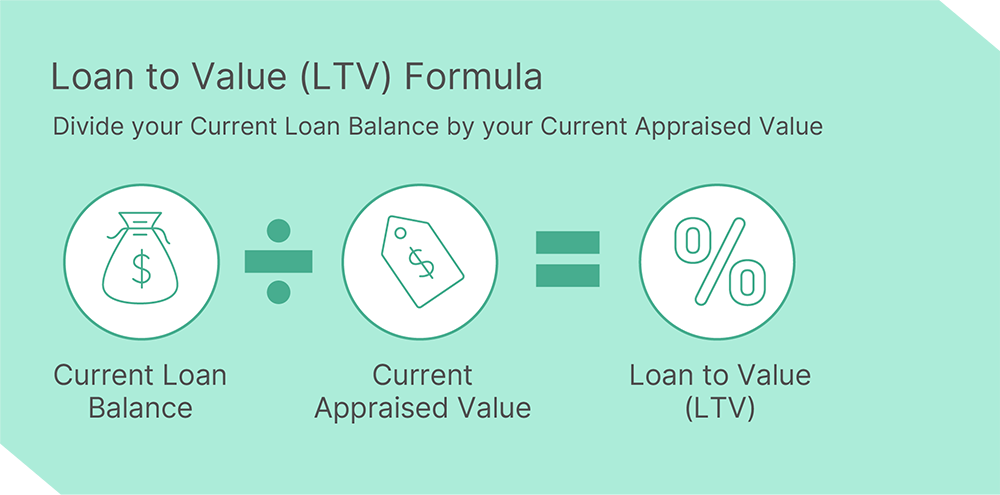

Loan-to-value (LTV) Ratio

When taking out a loan from DSCR, the lender will ask for an appraisal of the property to make sure that the value is compatible with the amount of money they are lending. An appraisal of the rental property is a typical requirement of the loan process to assess its worth.

LTV defines the amount a lender will loan on a particular property in reference to that valuation. For instance, if you are looking to buy an investment property with an appraisal of 100,000 and your lender loans 70% LTV, then you can expect a loan on this property for 70K. If your contract for purchase is for 80,000, you must bring at least 10,000 to closing.

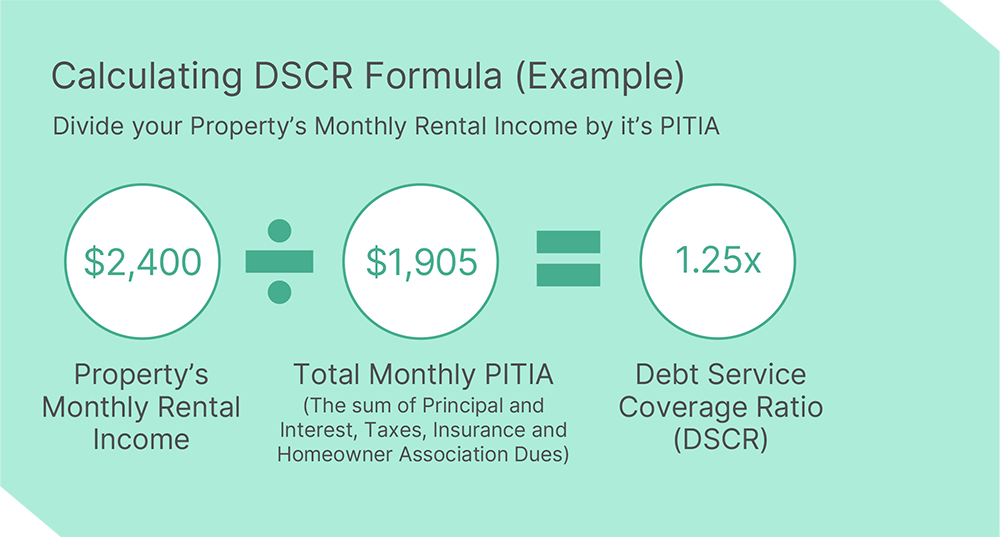

What is a Good DSCR Ratio?

Most hard money lenders require a minimum DSCR ratio of 1.00. If a DSCR ratio is 1.25, the borrower can make loan payments and have some extra cushion.

How do you Calculate DSCR?

DSCR is calculated by dividing the monthly rental income by the PITIA (Principal, interest, taxes, insurance and association dues).

DSCR Loan Example

A real estate investor is considering taking a DSCR loan for a rental property with a total rental income of $100,000 and an annual debt of $75,000. Dividing the two numbers gives a DSCR of 1.25, meaning it has 25% more income and cash flow than what is needed to cover the debt.

Why Bridge to DSCR?

Now that we understand the basics of a bridge loan, a cash-out refinance, and a DSCR loan, let's tie everything together. Going from a bridge loan to a DSCR loan makes logical sense from several standpoints.

LTC vs. LTV

First, the lender can typically lend at a higher LTC with a bridge loan —up to 90% towards the purchase price of a property. With a DSCR rental loan, however, lenders look toward LTV to determine how much they'll lend—typically around 70%. So, you're looking for anywhere 15 to 20% more buying power when you start first with a bridge loan.

The property is in need of rehab

As a real estate investor, it's very rare that you're buying a turnkey rental property that's ready to go with tenants already in place. Investors typically purchase cheap, run-down, distressed properties and renovate them quickly. A bridge loan is designed to provide the capital needed to purchase a property needing renovations and upgrades—sometimes including reimbursement for 100% of the rehab cost and no required appraisal.

A DSCR loan, on the other hand, looks at the value of the rental property and comes with a required appraisal from a third party. The valuation from the appraisal is a key factor in determining the loan amount.

A simple example of the math

Below is an example of the math in action for illustrative purposes only. For this hypothetical example, we're looking at Adam, a real estate investor with his eye on a distressed property to rehab and eventually hold as a rental. Because he doesn't want to deplete his cash reserves by buying and renovating the property, he turns to bridge financing.

Adam goes to his lending partner for a bridge loan. The lender looks at his FICO® Score to pre-qualify his application and approve the loan. Adam has a stellar credit score and gets approved at a 9% interest rate. While that's a higher rate than going with a traditional lender, Adam isn't concerned. He has plans to exit the deal in just a few months.

Let's break down the math on Adam's bridge loan:

Purchase Price: $100,000

Loan amount (90% LTC) for purchase: $90,000

Rehab cost: $40,000

Loan amount + 100% rehab reimbursement: $40,000

Total loan amount (purchase + rehab): $130,000

Additional loan costs (origination fees, closing costs, etc.): $2,500

Adam takes his bridge financing, closes on the property in 10 days and immediately gets started on the rehab. Once complete, the property's value has increased to $190,000. Because he finished the property in 90 days, he's happy he has a lender, like Kiavi, with a 90-day seasoning requirement on a cash-out refinance.

He's ready to move forward to a DSCR loan and hold this property as a rental. His lender orders a third-party appraisal, and – good news – they substantiate the value at $190,000. Adam qualifies for 75% leverage on the cash-out refinance and a lower interest rate of 7.250%–thanks to his FICO Score and DSCR–spread over 30 years.

Let's look at the math:

After-repair value: $190,000

Cash-out at 75% LTV: $142,500

Bridge loan pay-off: $130,000

The difference in cash (profit): $12,500

Adam is delighted—his cash-out matched his initial investment of $12,500. He's essentially reimbursed himself for what he paid for the property. He owns this newly-renovated rental property and has no problem getting quality tenants. Right away, Adam's property is cash-flowing—bringing in $300 monthly in passive income.

Adam plans to take his $12,500 and start the process again with another property in the same neighborhood.

Bottom line

Investors can maximize the returns on a rental property through a bridge loan and cash-out refinance. By renovating the property to increase its equity and value, real estate investors can increase its cash flow and use it to fund more real estate investments. To make this strategy successful, investors must thoroughly research the optimal rehab project and rental market. There will be some risk involved, but with proper planning and due diligence, investors can use this method to build a successful real estate portfolio.

A cash-out refinance of a rental property is basically the same as refinancing a primary residence. You take out a loan for the current value of the property, pay off the existing loan and keep the amount you've saved in cash. This money can be used to purchase another real estate investment or to build equity. Investing in real estate offers tax benefits and the potential for income and appreciation.