What Is Hard Money Lending for Real Estate?

Editor's Note: This post was originally published in February 2022 and has been completely revamped and updated for accuracy and comprehensiveness.

Hard money sometimes gets a bad rap, partly because of its name—it sounds a little scary, doesn't it? The term hard money brings to mind images of complicated processes or jumping through hoops for financing. However, such notions are entirely off-base—hard money loans quickly provide cold, hard cash, typically in just a few days.

The hard part of hard money actually refers to the tangible asset used to back the loan's value—in this case, real estate. Hard money fills a legitimate niche in real estate financing by giving investors options for short-term, real-estate-secured loans with faster turnaround times.

So, what are hard money loans? Let's dive into what you should look out for and consider the advantages and disadvantages of hard money loans.

What are hard money loans?

Hard money loans, sometimes referred to as bridge loans or investment property loans, are short and long-term secured loans that, as a real estate investor, you can use to finance an investment project. Instead of relying on a borrower's financial history and creditworthiness, hard money lenders weigh the merits of the investment at hand and use that investment (the property) as collateral. If you default on the loan, the hard money lender can recoup its losses by taking ownership of the asset.

Unlike traditional mortgages or other secured loans, hard money loans come with a fast and typically less stringent approval process. This makes them an ideal option for closing at the necessary speed to finance a deal in today's fast-moving market.

A traditional mortgage often takes more than a month, from application to close, to purchase a property. With hard money loans, closing in just a few days is possible.

What are hard money loans used for?

Below are some common use cases for real estate investors to seek hard money loans instead of traditional financing.

Fix and flip

Real estate investors who make money by purchasing distressed properties in need of rehab at a low cost, making repairs and renovations to boost the property's value and then flipping the home for profit often turn to hard money loans. These loans are ideal if you have a deal in hand and don't have time to go through a lengthy and cumbersome bank loan process.

As a fix and flip investor, you need guaranteed quick access to financing. Unlike traditional lenders, hard money lenders like Kiavi will work with you to find the best-matched loan program for your project and offer more benefits as you do more deals with them.

Additionally, because fix and flip investors generally try to sell the home within a short time—typically less than a year—you don't need the longer loan term (15-30 years) you'd get with a traditional mortgage.

Buy and hold

Real estate investors looking to flip a foreclosure to rent, those with a lackluster credit score, or those who don't want to jump through traditional lenders' hoops for long-term financing might seek out a hard money loan for their rental property investments.

Traditional mortgages have specific underwriting guidelines that each loan needs to meet, and income, assets, credit and collateral are all carefully reviewed to ensure that each loan meets these guidelines. As a result, it's often tricky for real estate investors to qualify for traditional mortgages.

Holding investment properties in an LLC also provides potential tax benefits—reducing exposure from a liability standpoint. Hard money lenders will allow you to purchase properties in the name of an LLC or corporation, which is something traditional lenders won't allow under their stringent guidelines. Additionally, unlike hard money lenders, traditional lenders restrict how many investment properties you can own, making them less than ideal if you're scaling your rental portfolio.

Commercial property

Business owners often turn to hard money financing for commercial real estate if they cannot secure traditional financing. Hard money loans can be helpful for commercial real estate investors purchasing a unique property that doesn't qualify for traditional financing. Traditional commercial loan limits are also often insufficient for their needs.

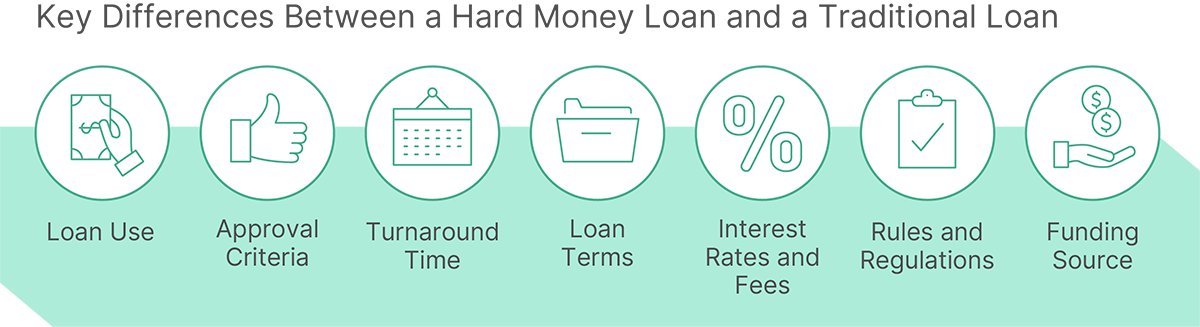

What’s the difference between a hard money loan and a traditional mortgage?

Hard money loans are generally designed for real estate investors who are buying property for profit. In contrast, traditional loans are often used to buy a home in which to live or an owner-occupied home. Below are other key differences between these financing options.

Approval qualifications

Approval for a traditional mortgage is based on the borrower's financial standing and whether you can pay off the loan over the allocated time. In contrast, hard money loans are focused on the investment opportunity of the property.

Traditional lenders will thoroughly examine your entire financial situation—your income, debt-to-income ratio (DTI), credit history, other assets and cash reserves, and the size of your down payment. Because hard money loans are asset-based and aren't 100% contingent on your creditworthiness, you can skip these arduous income and employment verifications.

A hard money lender will look more closely at the property by determining your asset's after-repair value (ARV)—the property's value after the rehab is complete. It’s pretty standard that a hard money lender will fund up to a certain percent of the ARV (lenders like Kiavi will finance the rehab up to 100%!) of the property you’re looking to flip. While they will look at your credit score to pre-qualify you for the loan, hard money lenders like Kiavi will do a soft credit pull, which won't affect your credit score.

Speed and flexibility

As previously mentioned, hard money loans have a faster approval and underwriting process than traditional loans. In addition, because hard money lenders don’t have the same strictly-enforced guidelines to follow for their loan applications, they can provide flexible loan terms and options and are more willing to help structure loans that work for a given project.

On the other hand, a traditional mortgage typically has much longer loan terms (anywhere between 5 and 30 years). While traditional lenders provide options for choosing between a fixed rate and an adjustable rate, there isn't as much room for flexibility.

Interest rates

Rates for traditional mortgages can be as low as 4-5% depending on the borrower's creditworthiness and the amount of the property being mortgaged. However, interest rates for hard money loans can range between 7-15% (sometimes higher). The difference is primarily due to the higher risk of hard money lending and the shorter duration of the loan.

What are the pros and cons of hard money loans?

Before getting approval for a hard money loan, be sure to understand the pros and cons of this financing option.

Pros

- Faster approval process

- Approval is based on property, not credit history

- More flexible terms and loan options

- Less strict underwriting

- The opportunity to rehab distressed properties

Cons

- Higher interest rates

- Often require larger down payments and upfront costs like higher origination fees and closing costs

- Shorter terms mean less time to repay

- The lender can initiate a foreclosure on the property if you don't repay the loan within the given time frame

What should I know about working with a hard money lender?

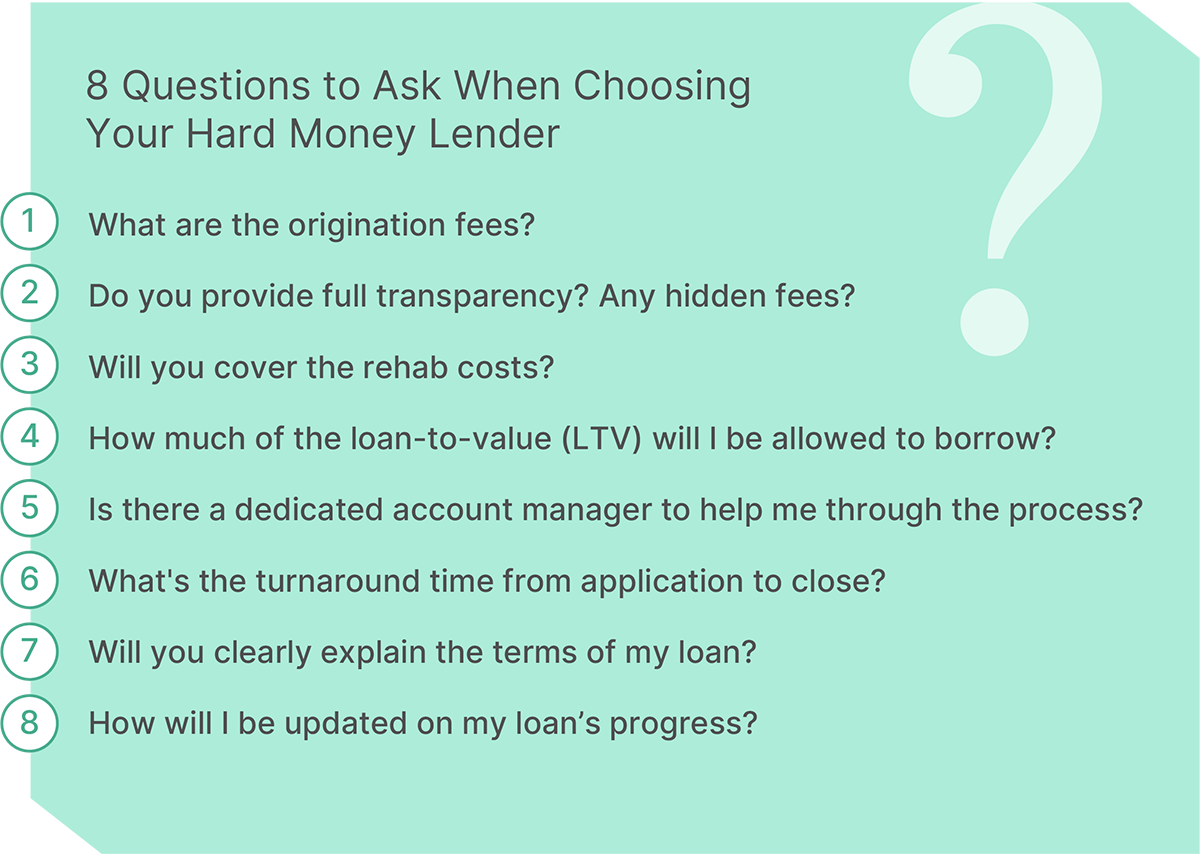

Not every hard money lender operates in the same manner. They differ in quality and price, so it's essential to select a lending partner who will best suit the needs of your business and maximize your returns. While the interest rates and loan amount are both critical factors, you should also prioritize looking for a lender with a solid track record for closing transactions quickly. In an industry where timing is everything, a trusted lender who can offer reliable capital and fast turn times can be the difference between winning or losing a deal.

The best hard money lenders will provide quick turnarounds, quick decision times, fair rates, and conditions that allow you to invest effectively while still maintaining a positive cash flow.

Final Thoughts

For various reasons, hard money loans can be a great option to finance a real estate investment. Hard money loans are popular among real estate investors, fix and flippers, developers, rental investors and rehabbers since they are quick and easy to obtain funding.

While the interest rates are higher than those of a traditional loan, the higher rate is mitigated by the fact that you can obtain the money much more quickly and that the loan is focused primarily on the property bought rather than your personal income or credit history.

When searching for a hard money lender, make sure you choose a well-established lending partner with a lengthy and reliable track record in the industry.

Leading lender to real estate investors across the US

Since its start in 2013, Kiavi has believed that real estate investors could benefit from the power of modern technology and tailored industry expertise. In just a few years, we've built an industry-leading team and a powerful technology platform that delivers the flexibility, speed, and simplicity that our customers rely on.