Working with Kiavi

Your guide to hard money loans

You've found the perfect property and are ready to move on the deal. Next stop? Financing. Real estate investors, house flippers, developers and rehabbers often use hard money loans. Why? Because it's a quick and easy way to secure funding. But what is hard money, and how is it different from conventional lending? Let's take a look.

What is hard money lending?

Hard money or a hard money loan is a term used to describe a type of secured loan that's backed by a hard asset—like real estate. Instead of relying on a borrower's creditworthiness, hard money lenders weigh the merits of the investment and use that investment asset as collateral.

You won't find hard money loans from a traditional lender like a bank or credit union. They come from individual investors, investing groups and financing companies.

Real estate investors use hard money loans to purchase investment properties. The investor may be a professional home flipper who wants to buy quickly to repair, rehab and sell a home. Or, they may be looking to buy, repair and rehab a rental property as a long-term investment without depleting their cash reserves to do so.

While a hard money loan is not the same as cash, there are instances where the two are considered comparable. Because hard money loans have shorter processing times than traditional loans, real estate investors can move on opportunities rapidly—just like with cash. In fact, hard money loans can be funded within a few days.

Hard Money vs. Traditional Loans

Let's look at some of the key differences between traditional and hard money loans:

Faster Closing

Closing on a traditional mortgage can take 30 to 60 (or more) days. In contrast, investors using hard money or private money lending can typically close in as fast as 7 days.

Easy, online loan application

Forget searching for pay stubs and old W-2s—hard money lenders like Kiavi don’t verify your income or employment. On top of that, Kiavi’s modern tech platform removes many traditional barriers and automates time-consuming manual steps—providing quick decisions and true transparency throughout the entire process.

Flexible terms

Hard money loans often have flexible repayment periods ranging from six months to several years. Traditional mortgages commonly have 15- or 30-year repayment terms.

Interest-only payments

Typically, with hard money loans, you can initially make interest-only payments or defer loan payments. You'll start repaying the principal and interest with a traditional mortgage.

Creditworthiness

Hard money lenders typically check your credit score or consider your real estate investing experience a qualifier. But, when approving the loan, they primarily focus on the property's value. With a traditional mortgage, however, your credit score and debt-to-income (DTI) ratio are significant factors in qualifying.

Down payments

You could be required to make a 20% to 35% down payment on a hard money loan based on the property's current value or its after-repair value (ARV).

The minimum down payment required for a traditional mortgage is 3%. Still, borrowers with lower credit scores or higher debt-to-income ratios may be required to put down more—a larger down payment is required for a jumbo loan or a loan for a second home or investment property.

Costs and fees

Mortgages and hard money loans each have closing costs, although these costs may cover different expenses. Both loan types can also carry penalties for paying them off early, but hard loans often have lower fees or shorter penalty periods.

Higher interest rates

In exchange for leveraging a lender’s money to buy a fix-and-flip property or start a rental portfolio, the convenience comes with caveats such as higher interest rates.

Hard money loans vs. Traditional loans

View and download our infographic for a quick-reference comparison of hard money loans vs. traditional home loans.

Who uses hard money loans?

Fix-and-flip investors

Fix-and-flip investors often turn to hard money to leverage funds—specifically, the use of borrowed capital—to increase the potential return on investment (ROI). Leveraging reliable capital through a fix-and-flip or bridge hard money loan can empower a new flipper working on one flip or bolster a seasoned rehabber working on a few simultaneously.

Buy-and-hold investors

Buy-and-hold real estate investors often choose hard money to finance their first rental property or accumulate multiple rentals into an extensive diversified portfolio. Such acquisitions are perfect for hard money loans designed for long-term rental property investment—often referred to as rental property loans or DSCR loans.

How to apply for a hard money loan

Hard money can be quicker and easier to secure an investment purchase without traditional financing or the approval process that banks and credit unions require. The result? A faster, more simplified approval process.

Since hard money loans are asset-based, they are not contingent on the borrower's creditworthiness. That means you skip arduous income and employment verifications of traditional financing that takes time and a lot of back and forth.

A hard money lender will look more closely at the property by determining your asset's after-repair value (ARV). While they will look at your credit score to pre-qualify you for the loan, most will just do a soft credit pull to get things started.

Hard money loan requirements

In contrast to traditional lenders, hard money lenders focus primarily on how sound the investment is when deciding whether to approve hard money loans. In other words, they care about how much profit is in your deal.

Each hard money lender will also have specific requirements for whom they consider a qualified borrower. Some will require a minimum credit score, at least 1-2 flips under their belt, and a certain percentage of the costs (downpayment) brought to the table. However, those requirements are usually less stringent than with a traditional lender.

Below are some helpful terms that hard money lenders look at to determine the soundness of an investment.

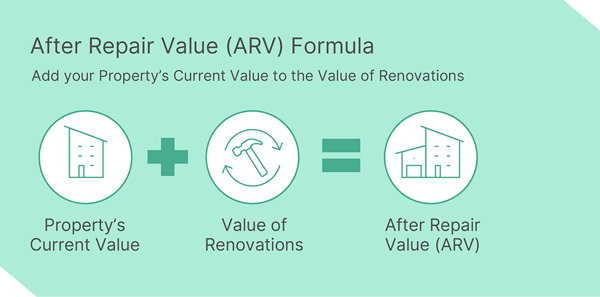

ARV: After-repair value

This term tells the value of a property once the rehab is completed. Most lenders will loan a percentage of this valuation to a borrower and then hold the repair funds in escrow.

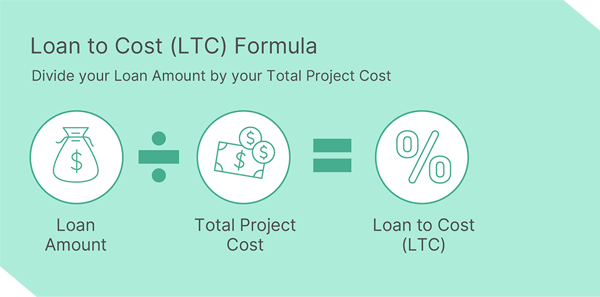

LTC: Loan to cost

Some lenders use this to tell us the percentage of funding one can expect on a purchase. For example, if a lender tells you that they loan 90% LTC, you can expect to receive a loan of 90,000 when your purchase price is 100,000. You will then bring the difference as a down payment at closing.

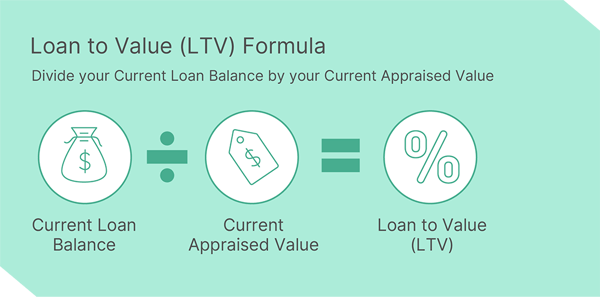

LTV: Loan to value

This term defines the amount a lender will loan on in regard to its valuation. For example, if you're looking to buy an investment property with an appraisal of $100k and your lender loans 70% LTV, you can expect a loan on the property for $70K. If your purchase contract costs $80k, you must bring at least $10k as a down payment at closing. If it is under, you may be able to cash out.

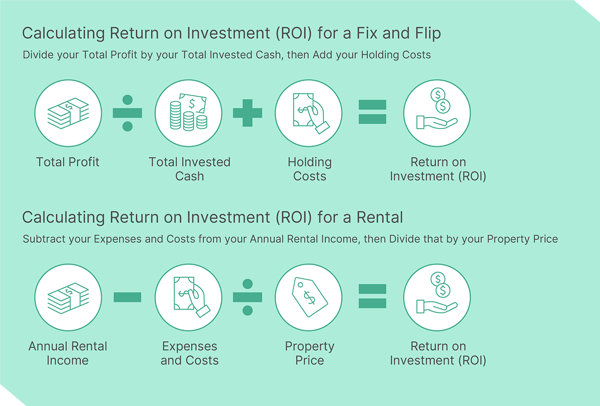

ROI: Return on Investment

The ROI metric helps real estate investors evaluate whether they should buy an investment property and compare one investment to another. ROI allows investors to predict, based on comparables, the profit margin they should receive from their real estate investment – either through house flipping or rental properties – as a percentage of the cost. For both experienced and first-time investors, ROI is a powerful tool that can be used to increase the chance of a profitable investment.

Traditional mortgage requirements

As mentioned, a traditional bank is mainly concerned about a borrower's creditworthiness when deciding whether to approve a loan, resulting in a more rigorous process for determining your fitness as a borrower. When determining approval, a traditional lender is lending based on you personally. They want to know your credit score, how long you've had your job, how steady your income is, your debt-to-income ratio, and more. Plus, they want detailed documentation as proof.

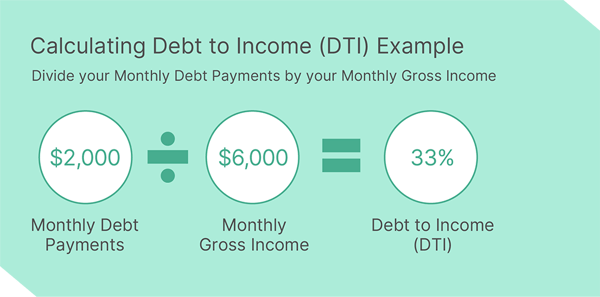

What is DTI?

Your DTI ratio is calculated by dividing your monthly debt payments by your monthly gross income. For example, if you pay $1500 a month for your mortgage, $100 a month for an auto loan, and $400 for the rest of your debts, your monthly debt payments are $2,000. If your gross monthly income is $6,000, your debt-to-income ratio is 33%.

Your DTI helps traditional lenders gauge your risk as a borrower and holds more weight than your actual income. A DTI of 50% or less will give you the most options when qualifying for a mortgage. In addition, it's ideal to have a score of 740 or above to qualify for a lower down payment, get a more attractive interest rate, and save on private mortgage insurance.

What are the risks of using hard money loans for real estate investment funding?

A hard money loan could seem like a quick and straightforward way to invest in real estate. However, higher interest rates and short repayment terms do not come without risks to the borrower.

For example, you might make interest-only payments initially and then have to repay the entire loan at the end of a 12-month term. But if you buy a home to fix and flip and there are delays during the rehab, or you can't find a buyer, you may be unable to repay the loan on time.

Some hard money lenders allow you to pay a fee to extend your loan's repayment term, but that plus extra interest could outweigh your returns. And if you can't repay the loan, the lender could foreclose on the property.

When considering a hard money loan, it's important to talk to your lender and ask all of your questions upfront. Also, like with any loan agreement, take the time to read the fine print. It's critical to understand the risks, terms and fees you'll encounter and how you must repay the loan. Doing so can help you avoid any unexpected surprises.

Making Smart Moves with Hard Money Financing

Hard money loans can be an excellent way to finance a real estate investment property. Real estate investors, house flippers, developers and rehabbers alike often use hard money loans as a quick and easy way to secure financing.

Compared to a traditional mortgage, the interest rates are higher. But, the higher rate is offset by the fact that you get access to the capital you need much more quickly, and the loan is based primarily on the purchased asset instead of your personal approval or credit. When looking for a hard money lender, just make sure to find a reputable lender with a long and trustworthy industry track record.

Ready to get started with a new property?

With a variety of fix-and-flip, rental, and new construction loan options, Kiavi’s dedicated team will help you maximize your ROI and create a simplified experience.