How to Get Started Investing in Rental Properties

Editor’s Note: This post was originally published in October 2021 and has been completely revamped and updated for accuracy and comprehensiveness.

While there are many ways to invest in real estate, investment approaches can be broken down into two primary categories – fixing and flipping a property to resell it quickly for a profit and buying and holding a property long-term to rent. Let's take a look at the latter.

With a buy-and-hold strategy, real estate investors reap the benefits of rental income, appreciation, and profits generated by the property. Investing in rental properties also provides passive income, stable cash flow, tax advantages, diversification, and leverage.

For those who aren't sure how to get started, we're digging into the information you need to keep in mind.

Why invest in rental properties?

Investing in rental has long been considered a sound investment–that sentiment continues to grow as tenant demand, occupancy levels, rental income growth, and property values soar. The white-hot rental market across the nation is spurring both seasoned real estate investors and beginners to dive in headfirst.

Rising home prices paired with increasing rents put real estate investors in a promising position, encouraging many investors to add new properties to their portfolios, even as mortgage rates have risen in 2022.

What are the benefits of rental properties?

Investing in rental properties benefits the real estate investor in different ways, like positive cash flow, potential tax benefits, and property appreciation, to name a few. Let's further examine what these benefits can mean to you.

Positive cash flow

In rental investing, positive cash flow is the goal, which is when money is added to your bank account monthly from your occupied rental properties. Once you begin to add more properties to your portfolio, many investors earn positive cash flow without having to go to a 9 – 5 job or punch a time clock daily.

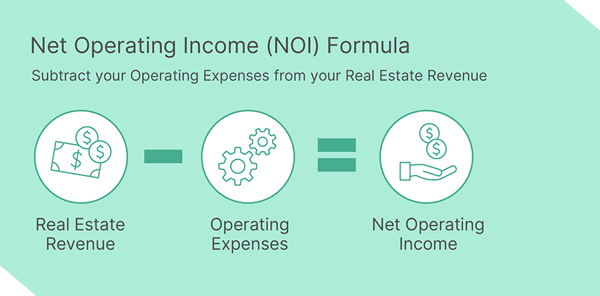

Determining the amount of positive cash flow you will receive on a rental property is basic math. You simply calculate the property's net operating income (NOI) by adding up the total rent minus all expenses. The resulting number is your positive cash flow.

Just be careful to consider all possible expenses when doing your calculations, including but not limited to:

- Mortgage and interest

- Property taxes

- Maintenance

- Property management

- HOA fees

- Vacancy costs

The recurring monthly income generated can provide you with a paved avenue toward financial security or a way to further pad your current income. This benefit further increases when you have multiple rental properties or invest in multi-family properties–more tenants and more passive income.

Appreciation and Equity

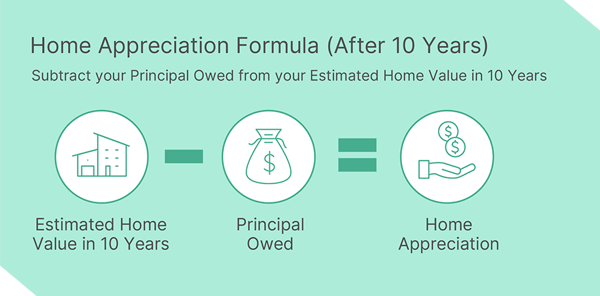

When investing in properties for rental purposes, you opt to hold on to the property for the long term. In comes appreciation—the value of real estate properties tends to increase over time.

With a good investment, you can turn a profit when you decide that it's time to sell. Plus, as you pay down the property's mortgage, you're also building an asset that makes up a part of your net worth—equity. Every month you collect rent, the funds you receive contribute to paying down the mortgage's principal, thus building up your equity.

As it builds over time, equity can give you the leverage you need to buy more rental properties and increase your cash flow even more.

Potential tax benefits

Several tax breaks can save you money as a rental real estate investor. For example, reasonable costs of owning, operating and managing the property are often deductible, saving you quite a bit when tax time rolls around.

Contact your tax advisor before getting started to learn more about the potential tax benefits of owning rentals.

Getting started

Ready to start investing in rental properties? Before you run out and start looking for properties, you should do a few things before jumping in.

Manage your debt

Interestingly, many new investors forego the opportunity to handle their personal debt before investing in rental property. While it's true that leveraging debt is a great way to make money, this typically only applies when the debt you accumulate provides a direct return.

In the context of real estate, owing money on a loan makes sense because you’re generating a financial return from your rental property. If you have debt like medical bills, student loans, car payments, etc., you will have significantly less spending power than someone who does not have these financial obligations.

However, if your projected return from your real estate investment can handle your debt obligations, you likely won't encounter any issues.

Evaluate your finances

When starting rental investing, it's best to understand your finances out of the gate. While rental investing can be highly lucrative, it isn't without its risks.

For example, should the property become vacant, you must have the cash reserves available to cover the monthly loan payment yourself until you get a new tenant.

If something doesn't go to plan with your rental property, having an emergency fund will not only ensure that you're covered but also lend to your peace of mind.

Know your contingency plans going in

Unexpected repairs that your responsibility can also come into play. It's best to give yourself some financial leeway to help you handle unexpected costs. Contingencies like broken pipes, damaged HVAC systems, etc., can quickly become costly with rental properties.

As a landlord, it's your duty to adhere to specific regulations. Although these vary from state to state, they typically provide access to a safe environment and basic utilities such as electricity.

So, it simply isn't an option to avoid paying for situations that need your attention. In general, setting between 20% to 30% of your rental income aside is recommended to help you manage problems that arise.

Research the local market

Location is everything—the more extensive research you do, the better it will be for you to find a profitable property and tenants with low turnover.

The amount of money you'll earn from your property depends highly on its location. In certain areas, rentals are cheap, and in others, tenants are likely to pay more, and you want to be in the know about what those areas are.

You're at a disadvantage without researching the best neighborhoods for potential tenants to live in. It's wise to look for places with amenities, good schools, a strong workforce and low property taxes. Add in low crime rates, access to public transportation and popular restaurants, and you have a winner.

Get your financing

Securing financing is a big piece of the puzzle in real estate investing. Since rental investment loans require a higher level of expertise that not all lenders have, it's essential to do your due diligence to find a reputable, trustworthy lending partner that understands the unique financing needs of real estate investors.

Before choosing a lender for your rental investment, it's important to do independent research on your financing options. Reach out to your network for recommendations and consider the loan options, terms and conditions available with each lender.

Property management

Before becoming a landlord, you should plan how to manage your rental properties. Your success depends on your ability to manage your business efficiently and build a good reputation with tenants. If you don't manage your property well, you might have to sell it early or, even worse, lose it or possibly become bankrupt.

While managing your business is 100% your responsibility as an investor, you can opt to hire a professional property manager or management service to take a lot of the day-to-day duties off of your plate. A property manager helps to maintain the property and essentially acts as a middleman between owners and tenants.

Final Thoughts

Owning rental properties is a sound investment choice that has the potential to bring you to a place of financial freedom through rental income, appreciation, and profits.It will take time before you start earning a steady profit and achieving your financial security goals. If you do everything right, however, you could get to the point where you can leave your day job because you're earning enough passive income from your properties alone. But, you must first understand the basics.

If you're new to rental investing, make sure you work with an experienced real estate agent, a trustworthy lending partner and a good property management company to help ensure things run smoothly.